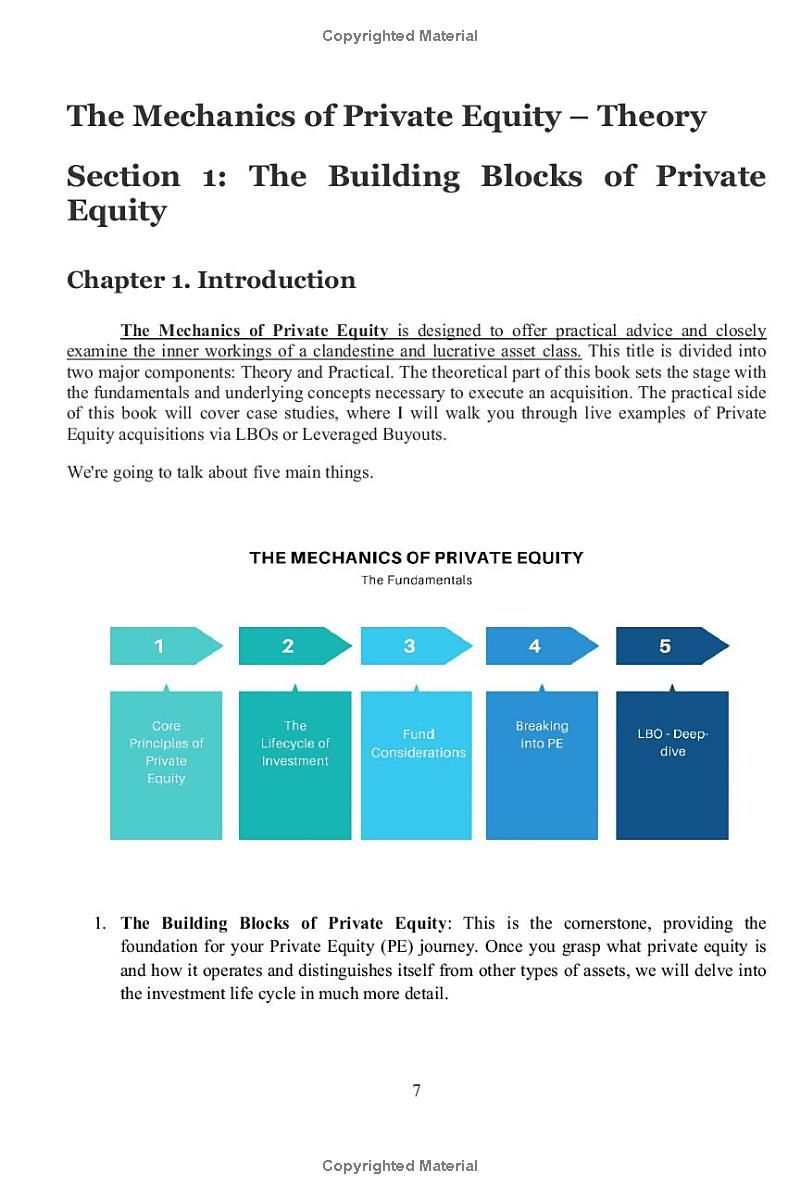

Unlock the secrets of private equity with "The Mechanics of Private Equity." This comprehensive guide demystifies this lucrative yet opaque asset class, providing practical knowledge and hands-on experience for aspiring and current professionals. Learn the fundamentals, from sourcing deals and executing investments to portfolio management and successful exits. Master leveraged buyout (LBO) valuation modeling through detailed case studies, including a deep dive into Dell's legendary LBO, and accompanying Excel models. Whether you're a startup founder, investment banker, or fund manager, this book equips you with the skills to navigate the complexities of private equity and build your career in this high-stakes world.

Review The Mechanics of Private Equity

I found "The Mechanics of Private Equity" by Umran Nayani to be a surprisingly engaging and accessible deep dive into a world often shrouded in mystery. The book’s title accurately reflects its content: it’s genuinely about the mechanics, the nuts and bolts of private equity. Forget vague generalizations; this isn't a fluffy overview. Nayani throws you right into the nitty-gritty of LBO valuation modeling, providing a level of detail that's both thorough and, surprisingly, easy to follow.

What impressed me most was the balance between theory and practice. The author doesn't just explain the concepts; he shows you how they work in real-world scenarios. The inclusion of numerous Excel model screenshots and step-by-step instructions is invaluable. You're not just passively reading about LBOs; you're actively participating in the process, learning by doing. This hands-on approach is what truly sets this book apart. The "Deal of the Century" case study on Dell's LBO is particularly enlightening, demonstrating the practical application of the principles discussed throughout the book. It cleverly bridges the gap between textbook theory and the messy reality of high-stakes finance.

The book is structured logically, building upon foundational knowledge step by step. Even someone with a limited finance background can grasp the core concepts and progressively build their understanding. Nayani avoids overwhelming jargon, explaining complex terms and techniques in a clear, concise manner. This makes the book readily accessible to a broad audience, from budding entrepreneurs and investment bankers to seasoned professionals looking to refine their expertise.

While the sheer volume of information might seem daunting at first (it’s a substantial 300+ pages!), the author’s writing style keeps it manageable. The explanations are clear, the examples are relevant, and the pacing is well-considered. The book isn't just about understanding the mechanics of private equity; it also provides valuable insights into deal sourcing, portfolio management, and exit strategies. It's a holistic view of the entire private equity lifecycle. This comprehensive approach makes it a valuable resource, offering actionable strategies that go beyond the mere financial aspects.

For those intimidated by the complexities of private equity, this book serves as a powerful demystifier. It dismantles the perception of private equity as an exclusive, opaque world, making it feel accessible and attainable. The inclusion of the "Napkin LBO" section, focusing on simplified one-page models, is particularly helpful for beginners. It illustrates that even complex financial instruments can be broken down into understandable components. It’s a confidence booster for those taking their first steps in this challenging field.

Ultimately, "The Mechanics of Private Equity" is more than just a textbook; it’s a comprehensive guide, a practical workbook, and a valuable tool for anyone interested in understanding and navigating the world of private equity. Whether you're aiming to break into the industry, enhance your investment strategy, or simply broaden your financial literacy, this book provides a robust foundation and equips you with the practical skills to succeed. The meticulous detail, clear explanations, and practical exercises make this book an invaluable asset for anyone serious about mastering the intricacies of private equity.

Information

- Dimensions: 6 x 0.56 x 9 inches

- Language: English

- Print length: 247

- Publication date: 2024

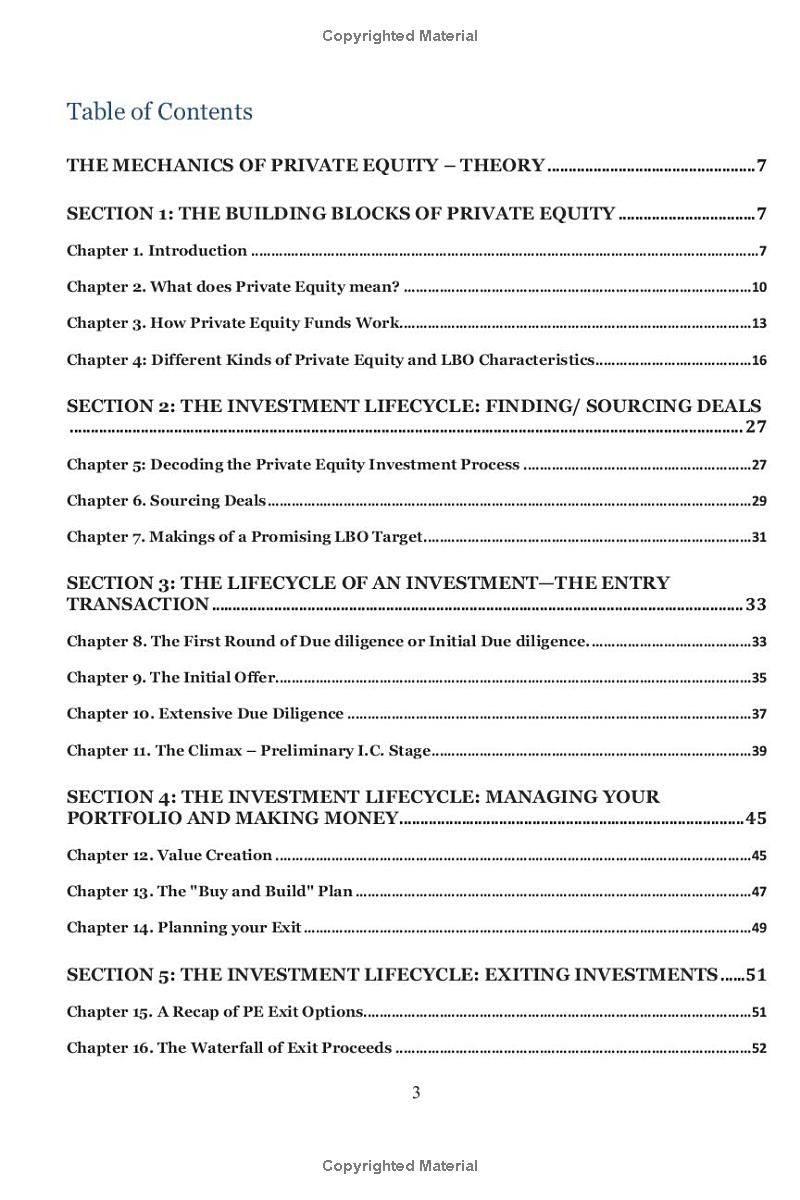

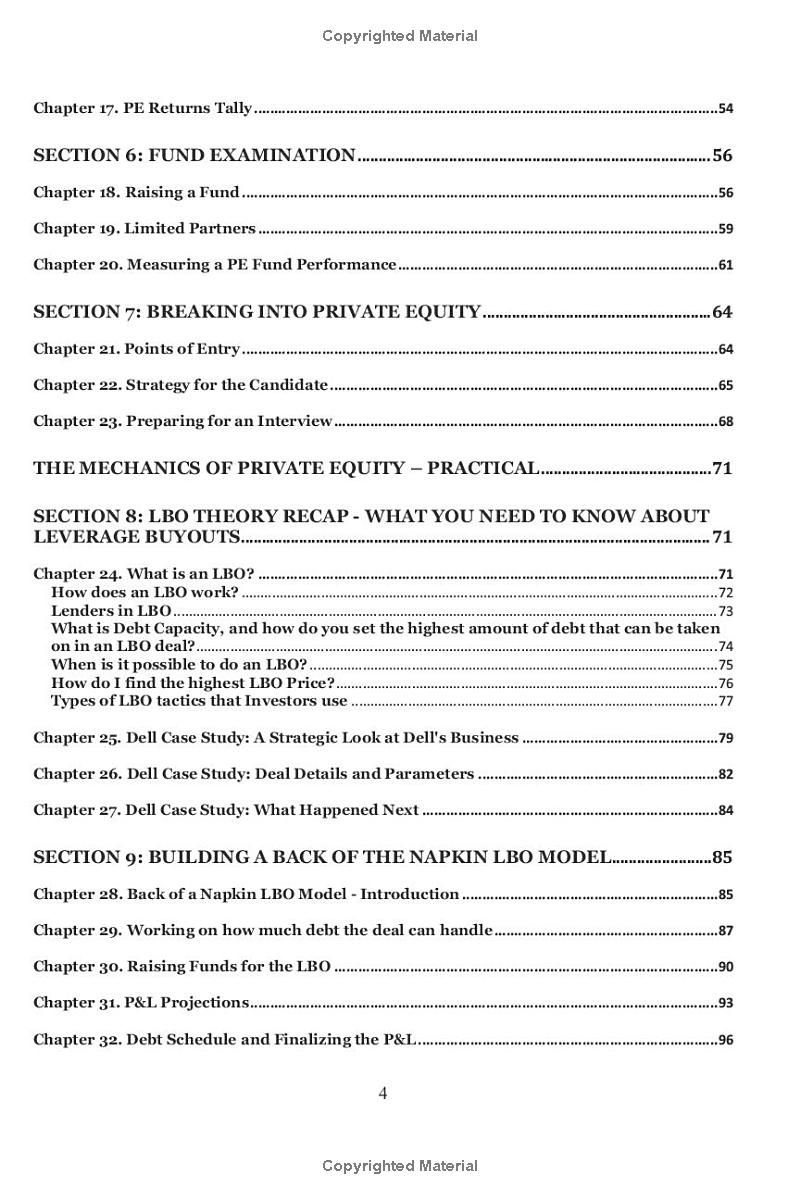

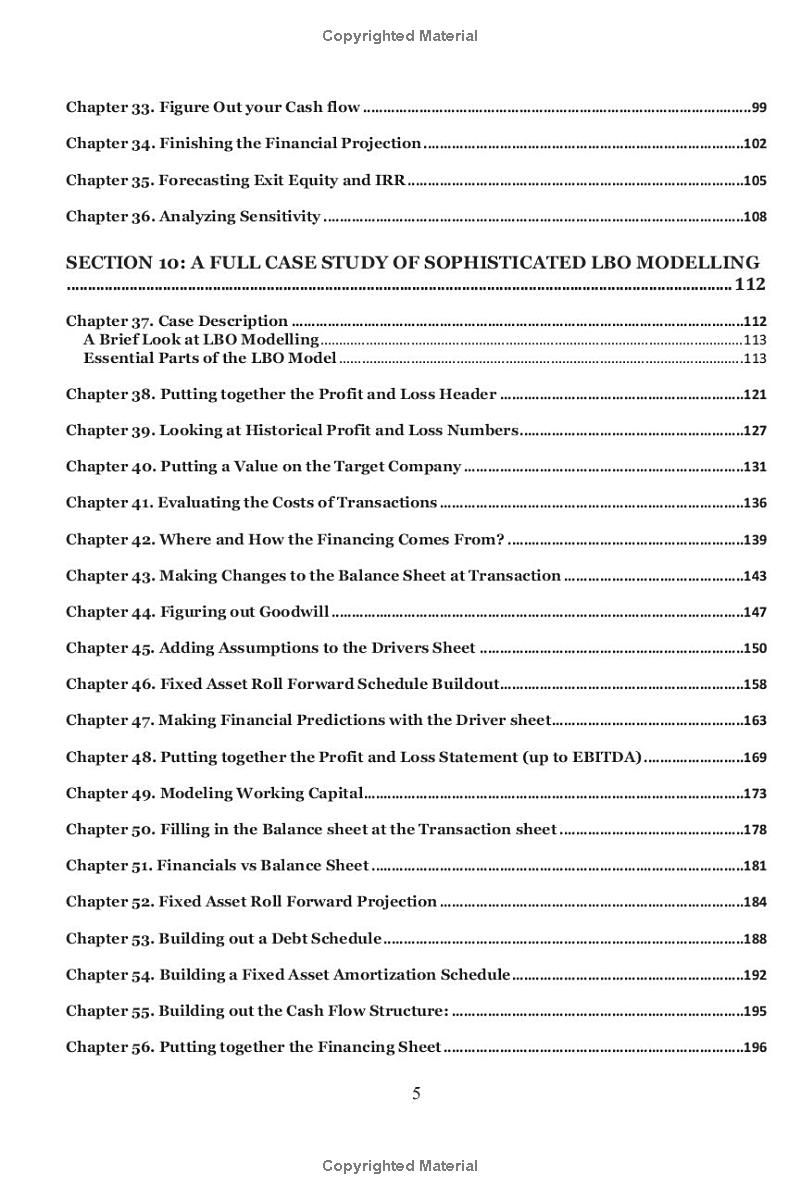

Book table of contents

- THEORY

- SECTION 1: THE BUILDING BLOCKS OF PRIVATE EQUITY

- SECTION 2: TIIE INVESTMENT LIFECYCLE: FINDING/ SOURCING DEALS

- SECTION 3: THE LIFECYCLE OF AN INVESTMENT-THE ENTRY TRANSACTION

- SECTION 4: THIE INVESTMENT LIFECYCLE: MANAGING YOUR PORTFOLIO AND MAKING MONEY

- SECTION 5: THE INVESTMENT LIFECYCLE: EXITING INVESTMENTS

- Chapter 17. PE Returns Tally

- SECTION 6: FUND EXAMINATION

- Chapter 18. Raising a Fund

- Chapter 19. Limited Partners

- Chapter 20. Measuring a PE Fund Performance

- SECTION 7: BREAKING INTO PRIVATE EQUITY

- Chapter 21. Points of Entry

- Chapter 22. Strategy for the Candidate

- Chapter 23. Preparing for an Interview

Preview Book